Important Update – Tax-Included Deposits on Estimates & Payroll Deduction Adjustments

Hello,

We would like to inform you of an important improvement made to your system to simplify transactions and ensure consistent accounting.

Deposits on Estimates

Now Tax-Included by Default

From now on, when you take a deposit on an estimate, the amount entered will be treated as taxes included.

In practical terms, if you enter a $100 deposit, the customer will see and pay exactly $100.

In the background, the system automatically generates an invoice linked to the corresponding estimate, and the amount is recorded as follows:

$86.96 in sales

+ applicable taxes

= $100 total paid by the customer

This approach simplifies the customer experience while maintaining accurate and compliant accounting for your business.

Payroll Deduction Adjustments

Aligning with Quebec Payroll Legislation

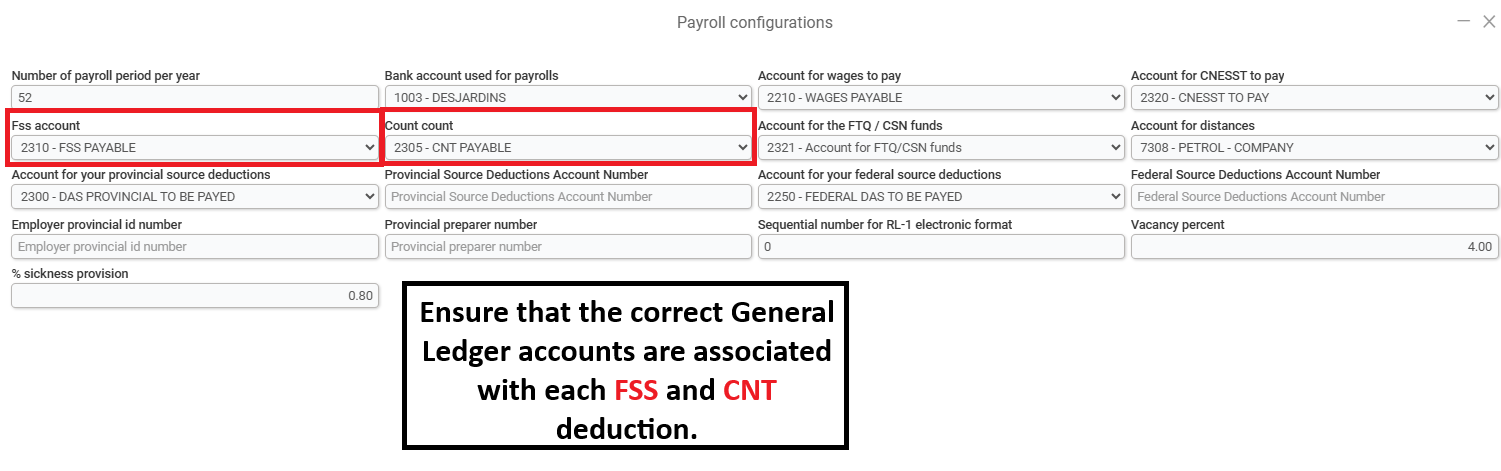

You will also notice adjustments in the payroll deduction section, specifically the addition of the FSS (Health Services Fund) and CNT (Labour Standards Commission) fields.

These additions were implemented to better align the system with Quebec payroll legislation.

To ensure proper accounting, please associate each of these new fields with the correct GL account.

How to proceed:

- Click on the Payroll module

- Click Settings

- Click Configuration

- Assign the appropriate GL accounts to each section

- Save

If you have any questions or need assistance with these adjustments, our team is available to support you.

Thank you for your continued trust.

The GEM Suite / V2V Technologies Team